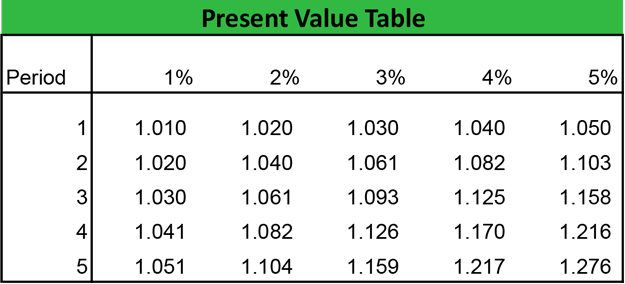

Present value of lump sum table

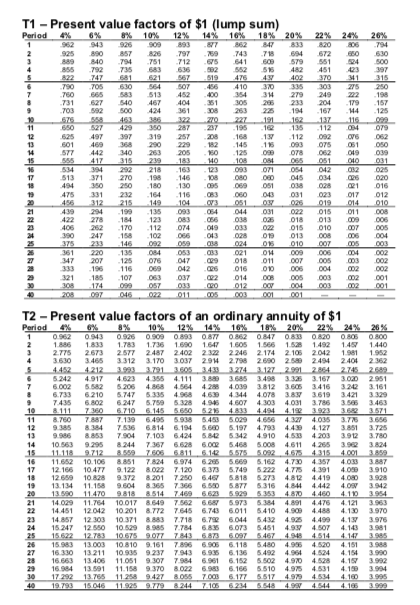

This determination requires the skills of an actuary and is called a lump-sum conversion. Present Value of Lump Sum Compounded Annually and Compounded QuarterlyhttpsyoutubecCPyfWR7IS0.

Annuities Amortization Present Value Lump Sum Payment And Balance Due Anil Kumar Lesson Gcse Ibsl Youtube

Lump Sum A lump sum is a complete payment.

. This syntax is valid for MATLAB versions R2018b and later. Textbook solution for Principles of Accounting Volume 2 19th Edition OpenStax Chapter 11 Problem 15Q. Under section 430 d 1 a plans funding target for a plan year generally is the present value of all benefits accrued or earned under the plan as of the first day of that plan.

The formula for calculating PV in Excel is PV rate nper pmt fv type. Generally for plan years beginning after December 31 2007 the applicable interest rates under Section 417 e 3 D of the Code are segment rates. S sum Aall computes the sum of all elements of A.

Calculate the present value investment for a future value lump sum return based on a constant interest rate per period and compounding. We have step-by-step solutions for your textbooks written by Bartleby experts. Means the annual retirement benefit adjusted to an actuarial equivalent straight life annuity if such benefit is expressed in a.

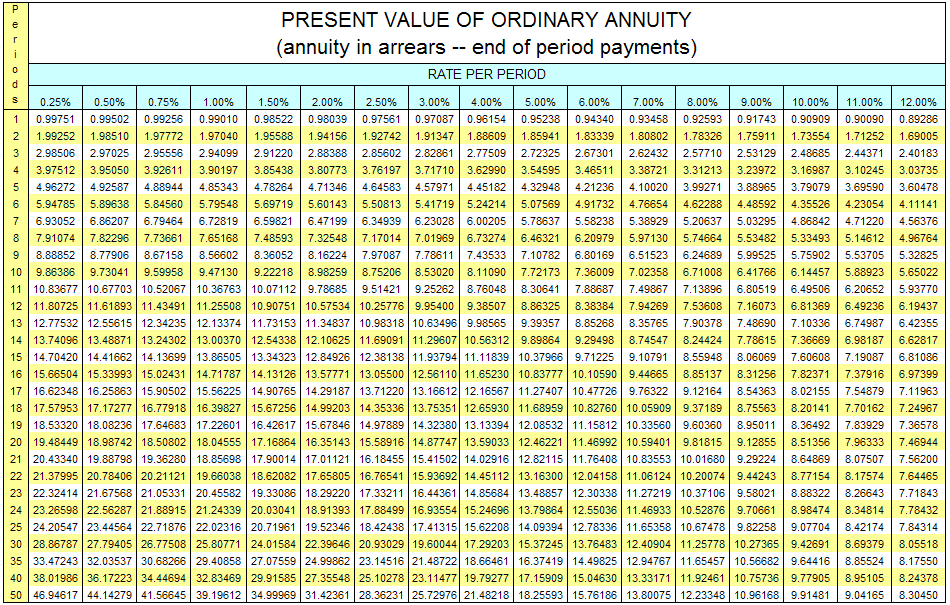

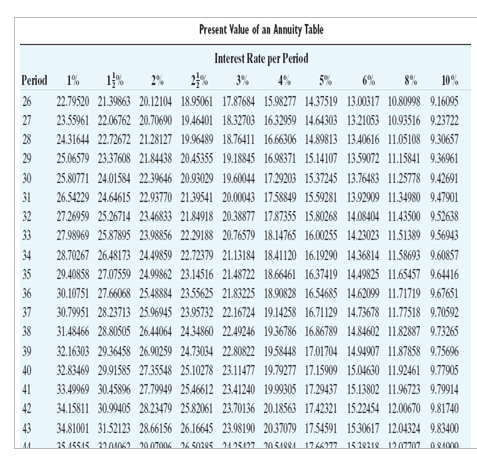

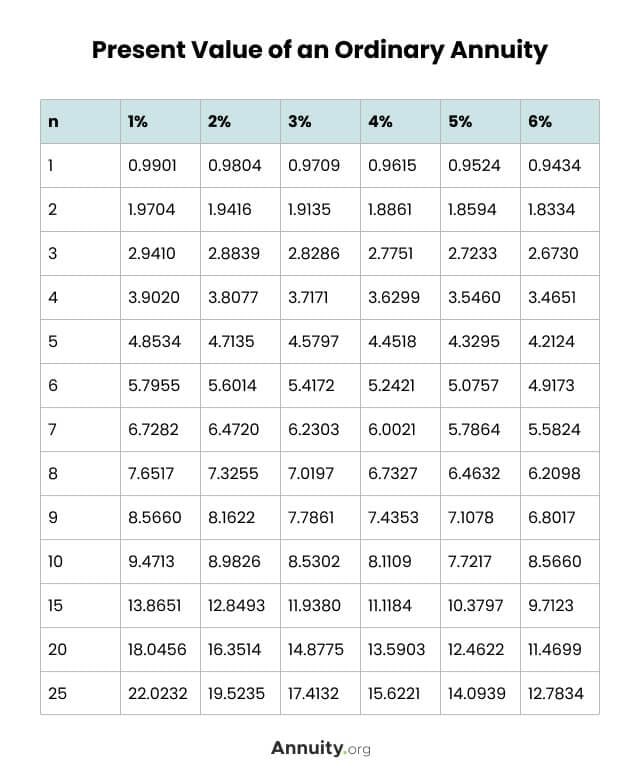

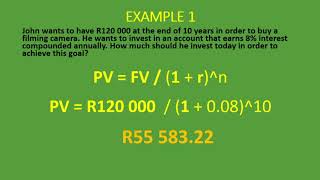

The loan is a ten-year note so we need to figure out what the present value of a 150000 lump sum is ten years from now. Purpose Sum numbers in a range that meet supplied criteria Return value The sum of values. The Present Value of Lump Sum Calculator helps you calculate the present value of lump sum based on a fixed interest rate per period.

Lump Sum Present Value. The lump sum value of an annuity may also be called the actuarial present value. As you can see the PV of the balloon payment is 5783149.

If we calculate the present value of that future 10000 with an inflation rate of 7 using the net present value calculator above the result will be 712986. Key Takeaways Present value PV is the current value of a stream of cash flows. 73601 Balance Accumulation Graph Principal Interest Balance 0 25 5 75 10 0 500 10K 15K Breakdown 76 24 Principal Interest Schedule Related Investment.

Click on the cell in your table where you want to see the total of the selected cells. This is a special instance of a present. S sum Adim returns the sum along dimension dim.

Lump - sum payouts are calculated by determining the present value of your future monthly guaranteed pension income using actuarial factors based on age mortality tables published. What that means is the discounted. Minimum Present Value Segment Rates.

Lottery Winner S Dilemma Lump Sum Or Annuity

Future Value Factors Accountingcoach

Present Value Formula And Pv Calculator In Excel

Federal Register Use Of Actuarial Tables In Valuing Annuities Interests For Life Or Terms Of Years And Remainder Or Reversionary Interests

Solved Present Value Of An Annuity Table Period 2 Interest Chegg Com

Present Value Of A Single Amount Quiz And Test Accountingcoach

Solved The Table Shows The Lump Sum Amount Of Money Chegg Com

Time Value Of Money Board Of Equalization

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities6-f3e0ae90db8b4a5398e3fcabd0538a92.png)

Calculating Present And Future Value Of Annuities

Present Value Of A Lump Sum Formula Double Entry Bookkeeping

What Is An Annuity Table And How Do You Use One

Present Value Formula Lump Sum Single Amount Formula With Examples Youtube

Present Value Formula Calculator Annuity Table Example

Lump Sum Present And Future Value Formula Double Entry Bookkeeping

Calculating Present Value Accountingcoach

Annuity Present Value Pv Formula And Excel Calculator

Solved Answer The Following Problems On Your Own Paper Chegg Com