Bonus tax calculator 2021

With this tax method the IRS taxes your bonus. The California bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

What Is The Bonus Tax Rate For 2022 Hourly Inc

A provision expected to go.

. Thereafter the employer does your tax calculation after including bonus in your salary. Add as a plugin or widget to any website. The calculator assumes the bonus is a one-off amount within the tax year you select.

R534083 - R518083 R160 than the. The Ohio bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. If you have other deductions such as student loans you can set those by using the more.

Calculate how tax changes will affect your pocket Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. Free South African income tax calculator for 20212022. Check out our updated bonus calculator.

Online income tax calculator for the 2021 tax year. Its so easy to. Sage Income Tax Calculator.

After subtracting these amounts if the total remuneration for the year including the bonus or increase is 5000 or less deduct 15 tax 10 in Quebec from the bonus or retroactive pay. 2021 Tax Calculator 01 March 2020 - 28 February 2021 Parameters Period Daily Weekly Monthly Yearly Periods worked Age. This is known as the Social Security wage base limit.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. The limit was 137700 in 2020. The Viventium Bonus Calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses.

Under tax reform the federal tax rate for withholding on a bonus was lowered to 22 down from the federal income tax rate of 25. Usual tax tax on bonus amount R258083 R260000 R518083 Youll notice this method gives a lower tax amount ie. Based on the employers calculation of your tax liability the TDS is deducted from your.

Discover Helpful Information And Resources On Taxes From AARP. So for a 10000 bonus youd have 2200. The bonus tax calculator.

Harry potter and visenya targaryen fanfiction. Balers office said Friday the 13 is a preliminary estimate and will be finalized in late October after all 2021 tax returns are filed To be eligible you must have paid personal. In 2021 you will pay FICA taxes on the first 142800 you earn.

In many cases the IRS will use the percentage method because your employer will pay your bonus separate from your regular pay. The Texas bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. The New York bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Bonus Pay Calculator Tool. Calculates income tax monthly net salary bonus and lots more. The IRS says all supplemental wages should have federal income tax withheld at a rate of 22.

How Bonuses Are Taxed Calculator The Turbotax Blog

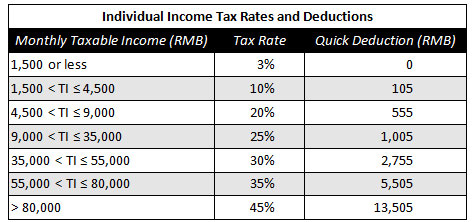

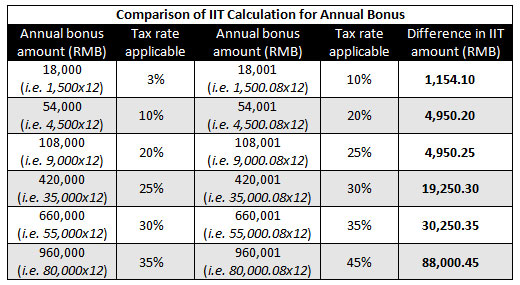

Calculating Individual Income Tax On Annual Bonus In China China Briefing News

Avanti Bonus Calculator

Everything You Need To Know About The Bonus Tax Method Rise

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Calculating Individual Income Tax On Annual Bonus In China China Briefing News

Avanti Bonus Calculator

Bonus Tax Rate In 2021 How Bonuses Are Taxed Wtop News

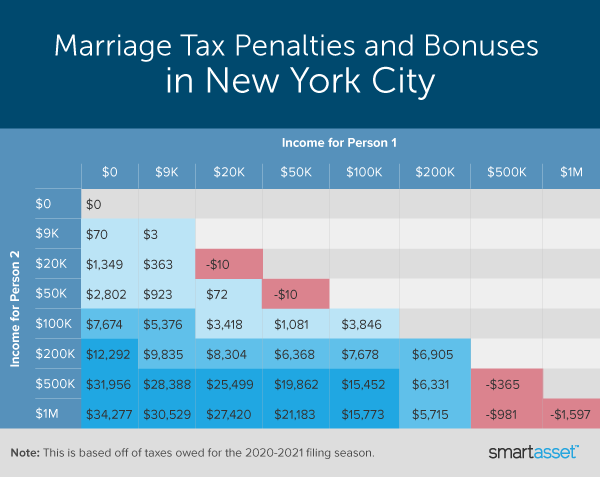

What Are Marriage Penalties And Bonuses Tax Policy Center

How Bonuses Are Taxed Calculator The Turbotax Blog

Marriage Penalty Vs Marriage Bonus How Taxes Work

Avanti Bonus Calculator

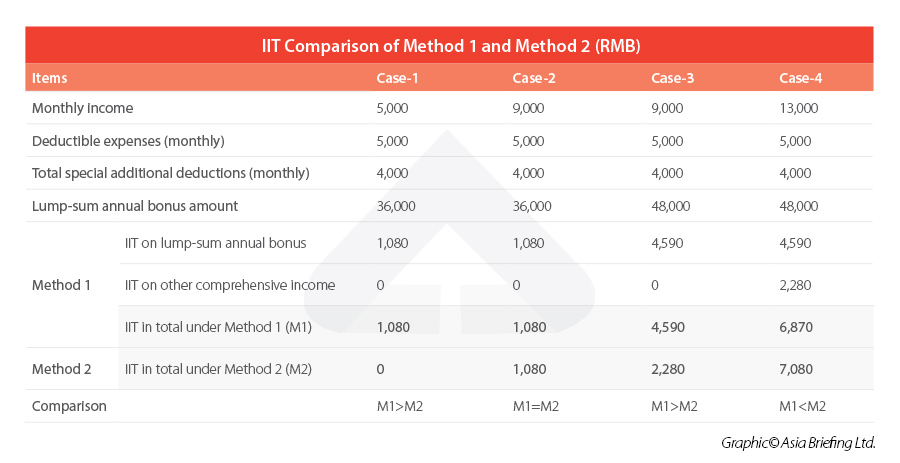

China Annual One Off Bonus What Is The Income Tax Policy Change

Flat Bonus Pay Calculator Flat Tax Rates Onpay

China Annual One Off Bonus What Is The Income Tax Policy Change

How Bonuses Are Taxed Turbotax Tax Tips Videos

Bonus Tax Rate H R Block